Building and Maintaining Multi-Generational Wealth

This is part of a new series of blog posts where we survey our data customers for insights into their industry.

For this article, we surveyed our wealth management and family-office customers for their advice on building and maintaining multi-generational wealth.

Creating multigenerational wealth is a goal many families strive to achieve, aiming to provide financial security and opportunities for future generations. Here’s a detailed guide on how to build and sustain wealth across generations, backed by statistics and expert insights.

Educate the Next Generation

Financial literacy is crucial for maintaining wealth across generations. Families should prioritize educating their children about money management, investing, and the importance of saving.

70% of wealthy families lose their wealth by the second generation and the percentage goes up to 90% by the third generation, according to the Williams Group wealth consultancy.

Impact of Financial Education: A 2021 study by the National Endowment for Financial Education (pdf https://www.nefe.org/initiatives/financial-education-policy-convenings/Financial-Education-Policy-Convening-Events-Summary--EBOOK.pdf) found that individuals who receive financial education are more likely to save regularly, manage debt effectively, and make better financial decisions.

Start Early with Saving and Investing

One of the foundational steps in building wealth is to start saving and investing early. The power of compound interest significantly benefits those who begin investing earlier.

“People habitually underestimate the power of compounding.

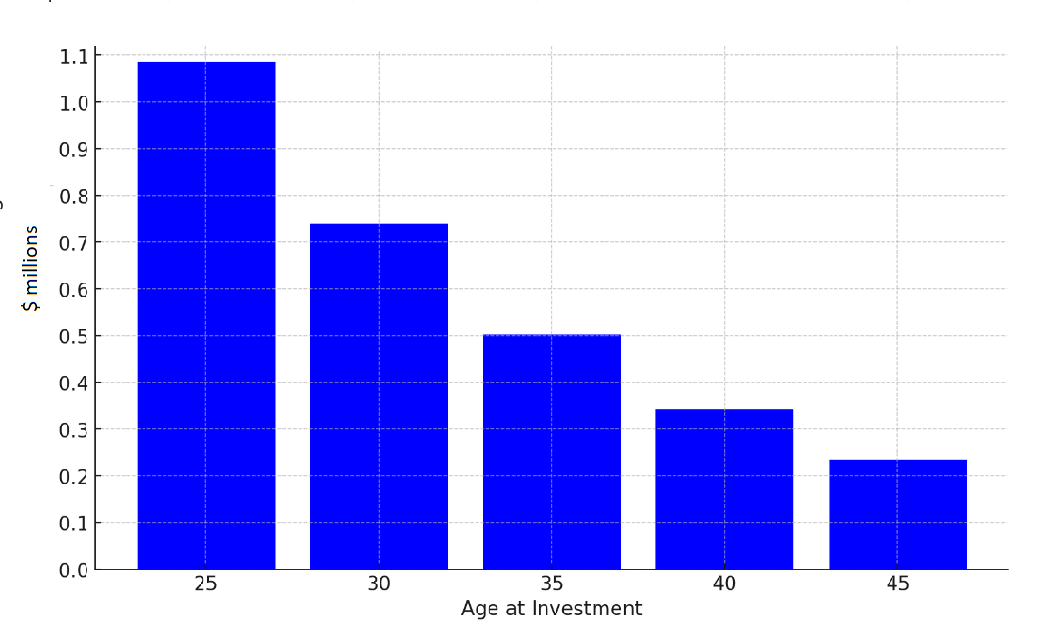

Most do not consider investing in their 20s even if they have the means to save” notes Stephen Milligan, Director at Cambridge Associates a boutique family-office advisory. The below graph illustrates this effect by showing the value of a $50,000 investment made when an individual is either 25, 30, 35, 40 or 45. The value of the investment at age 65 is $1.1 million if the investment was made at age 25, versus $700k if the individual was 30.

Consistent Investing

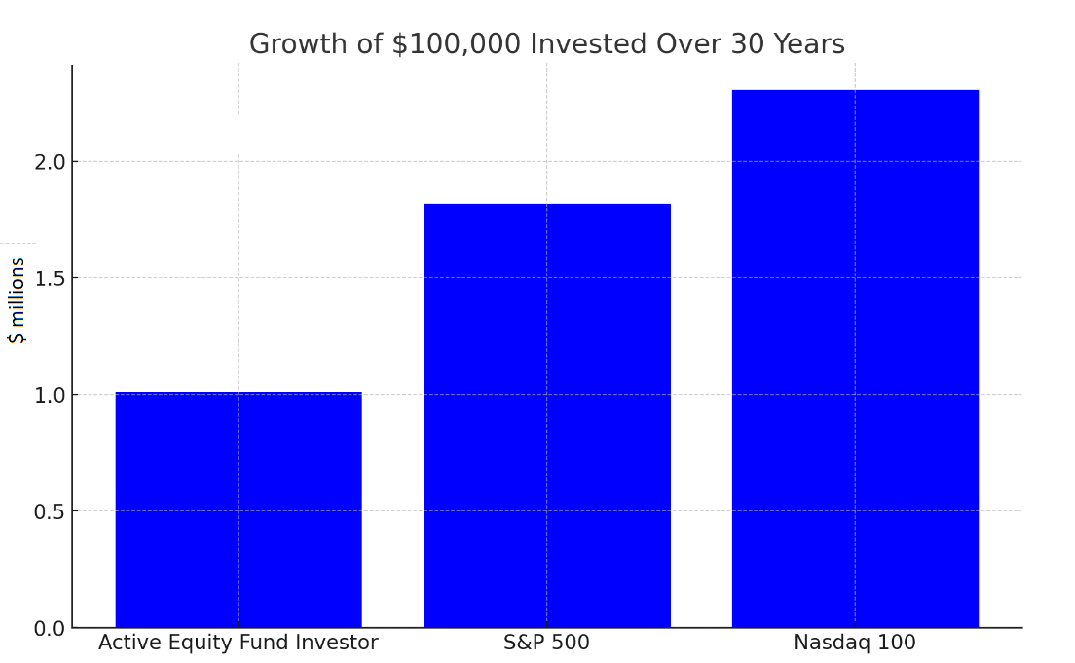

Day trading or the frequent purchase and sale of stocks attempting to jump on market trends almost always leads to the erosion of long-term gains. A study by Dalbar showed that individual investors actively managing their portfolios significantly underperform benchmark indices due to a mixture of poor timing and behavioral biases over a 30-year period.

Diversification

Diversification helps mitigate risks and increase the potential for returns. The single biggest mistake most people make in diversifying their investments is failing to consider their industry. A real-estate agent already has significant exposure to the real-estate industry and should avoid investments with real-estate exposure so stocks such as REITs should definitely be avoided.

Estate Planning

Proper estate planning is essential in ensuring wealth is transferred smoothly to the next generation without significant losses due to tax or legal issues.

Wills and Trusts: Only 32% of Americans have a will, according to a 2020 survey by Caring.com. Establishing wills and trusts is crucial to protect assets and ensure they are distributed according to your wishes.

Estate planning is especially critical for family-owned businesses. A standard will which distributes shares in the company amongst the family can lead to corporate paralysis as the new shareholders may have different views on the company’s strategy. It is imperative to separate control and ownership so control over the company will be concentrated in a few individuals and the non-voting shareholders will still enjoy the financial benefits of the company’s success.

Investment Types

Investing across different asset types (including stocks, bonds, and real estate) can increase your portfolio returns as well as reducing portfolio volatility. Most investors select a single asset type they are familiar with and channel most of their investments into that asset type.

Stock investors often ignore real-estate investing due to the larger upfront costs as well as administrative overhead.

According to a 2020 Federal Reserve study, the median net worth for homeowners is almost 40 times that of renters. Dermott Reeve of Claremore & Owings noted that ‘a major benefit of investing in property is that it is one of the few asset classes that individual can use leverage safely - leveraging stock investments is extremely risky for individual investors, however, most property purchases are made with at least five times leverage.

Leverage Tax-Advantaged Investments

Utilizing tax-advantaged accounts such as 401(k)s, IRAs, and 529 college savings plans can maximize savings by reducing tax liabilities.

Most investors take advantage of contributions to traditional 401(k) and IRA accounts being tax-deductible, however, more advanced tax management techniques such as tax-loss harvesting (where loss-making investments are sold to realize the loss and shelter profits on other investments from tax) are less frequently used by investors due to their complexity and administrative overhead.