Historical Options Chains

We have just added Historical Options Chains to our data offerings. Option chains are the most efficient method of organizing the large number of outstanding options on a ticker.

What is a Historical Option Chain?

The biggest difference between option data and data for other instruments is that there are numerous options for an underlying ticker (such as AAPL) whereas there is usually only a single equity or futures contract.

Since, at any point in time, there are multiple options for a given ticker, we need a method to structure and organize these options for analysis and interpretation.

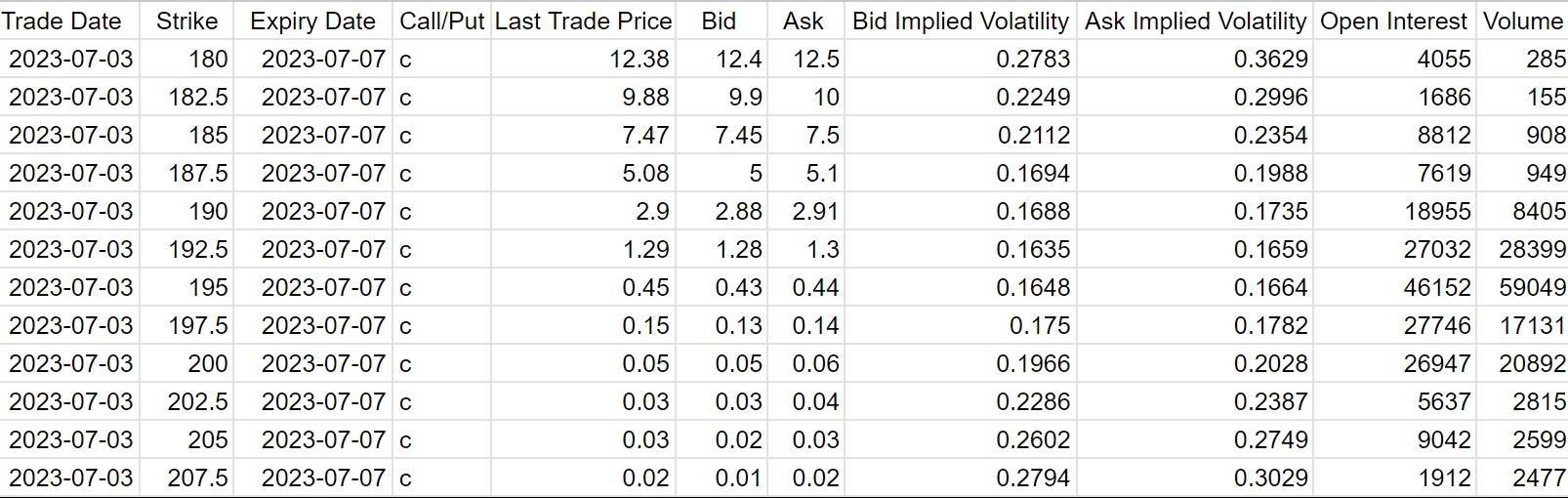

A historical option chain is the listing of active options for a given trading day, ordered first by expiry and then by strike price. Each option has both a bid and ask quote, and the last trade price is sometimes also included. For example:

Bid / Ask Quotes versus Trade Prices

For most instruments such as equities or futures contracts, executed trade prices are typically used for analysis as these prices reflect the actual levels that could be traded during the day. However, for options, since trading is spread over numerous (sometimes over 200) contracts, the trade prices may be stale and unreflective of the current market price.

Thus, for options, bid and ask quotes are typically used for analysis since these always reflect the current market prices.

Bid and ask quotes also have the advantage of better simulating slippage - which is the difference between the theoretical price on a trade and the actual price that is executed (for analysis using only traded data a bid/offer spread needs to be estimated).

Other Information

The most important information in the options chain is the bid/ask prices (and associated implied volatilities), however, the chain will also include other important data. Volume (the total number of contracts traded during the day) and open interest (the total outstanding number of contracts at the end of the day) can be used to assess the liquidity of the option contract.

In addition, option chains typically include Greeks for each option. These are the sensitivities of the option price to the five factors that influence the option price. Specifically

- Delta - option price sensitivity to the underlying asset’s price

- Vega - option price sensitivity to volatility

- Gamma - option’s delta sensitivity to the change in the underlying asset’s price

- Theta - option price sensitivity to time (also called time decay)

- Rho - option price sensitivity to the risk-free interest rate

We have just launched our historical options data bundle which includes historical option chains for over 5000 equity and index tickers starting 2010.